by ETC Group

Policymakers could still block the agribiz mergers; peasants and farmers will continue the fight for seeds and rights

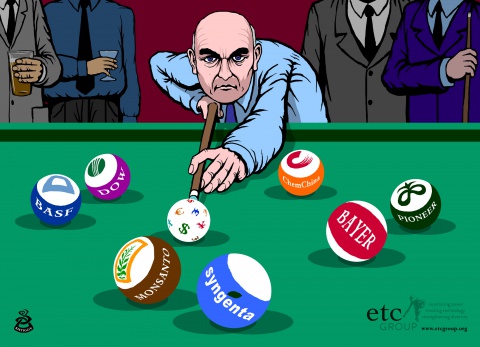

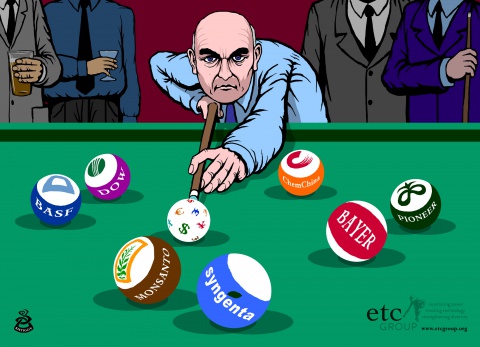

Wednesday’s confirmation that Monsanto and Bayer have agreed to a $66 billion merger is just the latest of four M&A announcements, but at least three more game-changing mergers are in play (and flying under the radar). The acquisition activity is no longer just about seeds and pesticides but about global control of agricultural inputs and world food security. Anti-competition regulators should block these mergers everywhere, and particularly in the emerging markets of the Global South, as the new mega companies will greatly expand their power and outcompete national enterprises. Four of the world’s top 10 agrochemical purchasing countries are in the global South and account for 28% of the world market.[1] If some of these throw up barriers, shareholders will rebel against the deals regardless of decisions in Washington or Brussels.

“These deals are not just about seeds and pesticides, but also about who will control Big Data in agriculture,” says Pat Mooney of ETC Group, an International Civil Society Organization headquartered in Canada that monitors agribusiness and agricultural technologies. “The company that can dominate seed, soil and weather data and crunch new genomics information will inevitably gain control of global agricultural inputs – seeds, pesticides, fertilizers and farm machinery.”

Neth Daño, ETC’s Asia Director, continues, “Farmers and regulators should be watching out for the seventh M&A – John Deere and Company’s bid to merge its Big Data expertise with Monsanto-owned Precision Planting LLD. After the Bayer-Monsanto merger, it’s not clear whether Precision Planting will go to Deere and Co. or if Bayer will protect its future in agricultural data.” Daño, based in the Philippines, points out that “Deere started connecting its farm machinery to GPS in 2001 and since then has invested heavily in sensors that can track and adjust seed, pesticide and fertilizer inputs meter by meter. The company has 15 years of historic data as well as access to terabytes of other weather, production and market data. Quite literally, Deere and the other farm machinery companies (the top three account for half of the world market) own the box in which the other input enterprises have to dump their products. That means Deere also owns the information.”

Silvia Ribeiro, Director of ETC’s Latin American office, agrees that the latest news confirming Monsanto agreement has “created alarm throughout Latin America and raised big concerns about increased input prices, more privatization of research and huge pressure from these Giant companies to make laws and regulations in our countries that allow them to dominate markets, crush farmers’ rights and make peasant seeds illegal.”

Although the mergers will be contested at the national level around the world, Neth Daño in the Philippines and Silvia Ribeiro in Mexico see the battle moving to a number of international fora in the weeks and months ahead. Daño will be in Indonesia September 27 – 30 when governments, farmers’ organizations and civil society meet to discuss Farmers Rights as part of a legally binding treaty intended to guarantee farmers access and use of seed. “This is an international seed meeting that can’t avoid addressing these mergers,” she asserts. “The hottest topic on the agenda is a Big Data proposal for seeds being pushed by the companies.”

October 17 – 21, Pat Mooney and Silvia Ribeiro will be in Rome attending the UN’s Committee on World Food Security. “Virtually all of the world’s governments, farmer organizations and many agribusinesses companies will be in the same room for a week, with food security on the official agenda. There are going to be a lot of angry people there wanting to stop these mergers,” Ribeiro insists.

December 4–17, the UN Convention on Biological Diversity will be meeting in Mexico where agricultural biodiversity issues are on the agenda. The Convention is famously proactive on seed issues having already set a moratorium against Terminator seeds (seeds genetically modified to die at harvest time forcing farmers to purchase new seeds every growing season) and, as well, a protocol on the trans-boundary movement of transgenic seeds and another protocol that will soon enter into force related to loss and damages caused by GM contamination. When it meets in December, it will debate the risks of a suite of new plant breeding technologies described as “extreme genetic engineering” (synthetic biology) which is much favoured by all the companies now merging as a strategy to sidestep biotech regulations. “Wherever these companies go in the next few months, they are going to have a fight on their hands,” says Silvia Ribeiro.

For further information:

Pat Mooney, Executive Director, ETC Group: 1-613-240-0045 or mooney@etcgroup.org

Neth Daño, Asia Director, ETC Group: +63 917 532 9369 or neth@etcgroup.org

Silvia Ribeiro, Latin America Director, ETC Group: + 52 1 5526 5333 30 or silvia@etcgroup.org

| M&As – Public and Not-So Public

The buying spree started in July 2014 when Monsanto (the world’s #1 seed company; #5 In agrochemicals[2]) launched the first of three runs at Syngenta (#1 in crop chemicals; #3 in seeds[3]). All offers were rebuffed. Nevertheless, the gambit set all of the Big Six seed/chemical companies in motion… 1. November 2015 – ChemChina (who owns the world’s 7th-largest agrochemical company, ADAMA[4]) made a $42 billion bid for Syngenta.[5] The offer (bumped up to $43 billion) was accepted in February 2016.[6] The deal has passed one of several regulatory hurdles in the USA,[7] but faces challenges in numerous other jurisdictions including, apparently, Canada, Brazil and the EU. It is expected to close by the end of 2016.[8] The merger will give ChemChina “a way to diversify beyond agrochemicals into GM seed technology.”[9] 2. December 2015 – Dupont (#2 in seeds, #6 in pesticides[10]) and Dow (#5 in seeds, #4 in pesticides[11]) announced their $68 billion merger. It is still pending and under review by antitrust regulators,[12] and the companies optimistically claimed the deal will be done by the end of the year. 3. May 2016 – Bayer (#2 in crop chemicals; #7 in seeds[13]) low-balled a bid for Monsanto[14] but the companies eventually reached a deal for $66 billion on September 14 and predict closure by the end of 2017.[15] 4. August, 2016 – Potash Corp. (#1 in synthetic fertilizers by capacity,[16] #4 by market share[17]) began negotiations with Agrium (#2 in fertilizers by market share[18]). The deal was agreed September 12, 2016, and was valued at $30 billion. Aside from making the new entity the undisputed No. 1 in fertilizers, it also broadens the base of the enterprise to include seeds and crop chemicals.[19] The deal is expected to close in mid-2017.[20] As the four negotiations went back and forth, the world’s other significant seed, chemical and fertilizer companies were looking on with a mixture of consternation and anticipation. Since it is highly unlikely that all four mergers can play through without divestitures, ETC predicts that at least two other M&A options are coming down the pipeline… 5. BASF (#3 in crop chemicals and a modest player in seeds[21]) either has to get bigger or get out, and is undoubtedly calculating the possibility of snapping up any smaller seed and pesticide companies that fall by the wayside if the other mergers proceed. Its second option is to go after the second-string of German, Dutch, US and Japanese seed/pesticide companies to cobble together a larger agricultural footprint. 6. The same second-string players may be thinking of doing the same thing—either picking up the leftovers or merging themselves. Though alarming to smaller companies, the mashing together of the giant companies also leaves them niches of opportunity. But a 7th M&A has been playing off stage; important on its own, but also a harbinger of much bigger changes that will impact global agricultural inputs in the months and years ahead… November 2015 – Deere & Co. (#1 in farm machinery and nothing much in seeds or chemicals[22]). agreed to buy Monsanto’s Precision Planting LLD.[23] In August 2016, however, Deere was sued by the US Justice Department to block the deal[24] because the merger would allow Deere to “dominate the market for high-speed precision-planting systems and be able to raise prices and slow innovation at the expense of American farmers who rely on these systems”[25]: Deere and Precision Planting LLD together would account for 86% of the precision planting market.[26] Deere and Monsanto said they would fight the decision.[27] Bayer may have changed all of this. |

References:

[1] Brazil is the world’s largest agrochemical market at US$10 billion, China is the 3rd largest agrochemical market at US$4.5 billion, Argentina is 8th at US$1.5 billion and India is 9th at US$1 billion. Source: ETC Group, “Merge-Santo: New Threat to Food Security.” Briefing Note. March 22, 2016. http://www.etcgroup.org/content/merge-santo-new-threat-food-sovereignty

[2] 2014 data. ETC Group, “Breaking Bad: Big Ag Mega-Mergers in Play.” ETC Group Communique 115. December 2015. http://www.etcgroup.org/sites/www.etcgroup.org/files/files/etc_breakbad_23dec15.pdf

[3] Ibid.

[4] Ibid.

[5] Aaron Kirchfield, Ed Hammond, Dinesh Nair, “ChemChina Is in Talks to Acquire Syngenta.” Bloomberg News, Nov 12 2015 – 5pm EST. http://www.bloomberg.com/news/articles/2015-11-12/chemchina-is-said-to-be-in-talks-to-acquire-syngenta

[6] Anonymous, “ChemChina Offers Over $43 Billion for Syngenta” Bloomberg News, February 3, 2016. http://www.bloomberg.com/news/articles/2016-02-03/chemchina-offers-to-purchase-syngenta-for-record-43-billion

[7] Michael Shields and Greg Roumeliotis, “U.S. Clearance for ChemChina deal sends Syngenta stock soaring.” The Globe and Mail. August 22, 2016. http://www.theglobeandmail.com/report-on-business/international-business/european-business/us-clearance-for-chemchina-deal-sends-syngenta-stock-soaring/article31484832/

[8] Syngenta, “ChemChina and Syngenta receive clearance from the Committee on Foreign Investment in the United States (CFIUS),” Press Release, August 22, 2016. http://www4.syngenta.com/media/media-releases/yr-2016/22-08-2016

[9] Lindsay Whipp and Christian Sheperd, “Takeover green light sparks anger in US.” Financial Times. September 7, 2016. (printed edition).

[10] 2014 data. Anonymous, “Top 20 Global Agrochem Firms: Growth Slowing Down,” Agropages.com. 30 October 2015; company reporting.

[11] Ibid.

[12] Jacob Bunge, “DuPont CEO Says Merger With Dow Still on Track.” The Wall Street Journal. July 26, 2016. http://www.wsj.com/articles/dupont-profit-beats-as-costs-decline-1469529581

[13] 2014 data. Anonymous, “Top 20 Global Agrochem Firms,” Agropages.com

[14] Jacob Bunge and Dana Mattioli, “Bayer Proposes to Acquire Monsanto.” The Wall Street Journal. May 19, 2016. http://www.wsj.com/articles/bayer-makes-takeover-approach-to-monsanto-1463622691

[15] Greg Roumeliotis and Ludwig Burger, “Bayer clinches Monsanto with improved $66 billion bid” Reuters. September 15, 2016. http://www.reuters.com/article/us-monsanto-m-a-bayer-deal-idUSKCN11K128

[16] Reuters, “Agrium and Potash Corp Are Merging to Make a Giant Fertilizing Company.” Fortune. September 12, 2016. http://fortune.com/2016/09/12/agrium-potash-corp-merger/

[17] 2014 Data. ETC Group, “Breaking Bad”

[18] 2014 Data. ETC Group, from publicly available information.

[19] Guy Chazan and James Fontanella-Khan, “Bayer urged by Monsanto shareholders to raise bid further.” Financial Times. September 6, 2016. http://www.ft.com/cms/s/0/9219b46c-7422-11e6-b60a-de4532d5ea35.html#axzz4KGHWYNW5

[20] Rod Nickel and Siddarth Cavale, “Fertilizer majors Potash and Agrium to merge, face tough scrutiny.” Reuters. September 12, 2016. http://www.reuters.com/article/us-agrium-m-a-potashcorp-idUSKCN11I0Z0

[21] 2014 data. Anonymous “Top 20 Global Agrochem Firms.” Agropages.com

[22] ETC Group, compiled from company reports

[23]John Deere & Company, “John Deere and The Climate Corporation Expand Options for Farmers.” Press Release. November 3, 2015. https://www.deere.ca/en_US/corporate/our_company/news_and_media/press_releases/2015/corporate/2015nov03-corporaterelease.page

[24] United States Department of Justice, “Justice Department Sues to Block Deere’s Acquisition of Precision Planting.” Press Release. August 31, 2016. https://www.justice.gov/opa/pr/justice-department-sues-block-deere-s-acquisition-precision-planting

[25] Ibid.

[26] Ibid.

[27] Ibid.